Recent Blog

Mutual Fund Basics – Indian Market

🔍 What is a Mutual Fund?

A Mutual Fund is a financial vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, gold, and other securities. These funds are professionally managed by Asset Management Companies (AMCs).

📌 You invest.

📌 The fund manager decides where to invest.

📌 You earn returns based on the fund’s performance.

🧠 Why Should You Consider Mutual Funds?

✅ Diversification: Spreads your risk across multiple assets

✅ Professional Management: Experts handle your money

✅ Affordability: Start SIPs as low as ₹100/month

✅ Liquidity: Easy to buy/sell, especially in open-ended funds

✅ Transparency: Regular disclosures & regulatory checks by SEBI

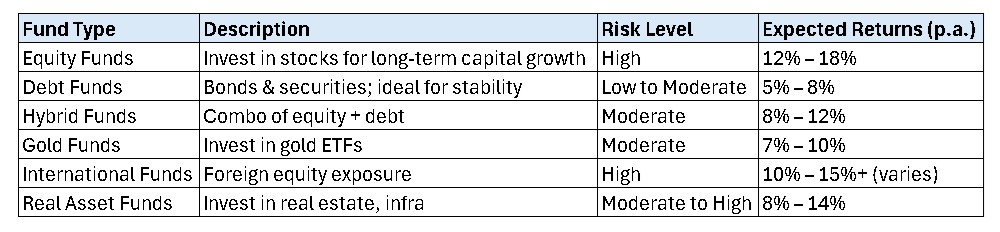

📊 Types of Mutual Funds in India

📈 Realistic Growth – How Much Can You Expect?

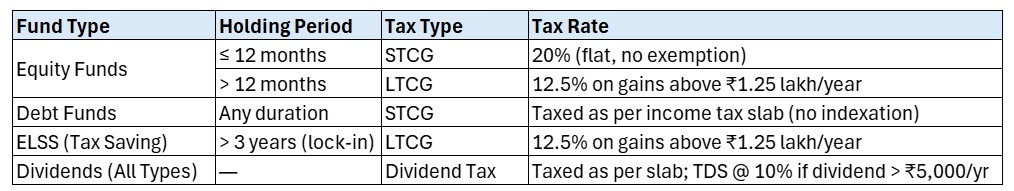

Equity Funds: 12%–18% annually (long-term)

Debt Funds: 5%–8% annually

Hybrid Funds: 8%–12% annually

ELSS: 10%–15% with tax benefits

🕒 Longer horizon = Higher compounding returns

📊 Mutual Fund Growth Trends (India 2024–2025)

💰 ₹58 lakh crore+ AUM (Assets Under Management) – July 2025

🚀 Massive inflows in SIPs – ₹20,000+ crore monthly

📈 Surge in midcap, smallcap, and thematic funds

🧑💻 Growing investor base from Tier 2 & Tier 3 cities

📊 Taxation Summary Table

🧭 How to Start Your Mutual Fund Journey?

1️⃣ Define Your Goals 🎯 Retirement, child’s education, dream home, or wealth creation? Start with purpose.

2️⃣ Know Your Risk Appetite ⚖️ Are you conservative, balanced, or aggressive? Your risk level shapes your fund choice.

3️⃣ Choose the Right Fund Type 📈 Short-term = Debt | Medium = Hybrid | Long-term = Equity/ELSS

4️⃣ Start SIP or Lump Sum 💸 Start small with SIPs or go big with lump sum. Automate & stay disciplined.

5️⃣ Track, Don’t React 🔍 Review your funds yearly, not daily. Ignore short-term noise—focus on long-term growth.

🔑 Pro Tips for New Investors

🌱 Start Early – Time is your biggest asset

📉 Don't Panic – Markets have short-term noise

🧾 Use SIPs – Rupee cost averaging over time

👩⚖️ Stay Compliant – Complete KYC, track tax rules

📊 Review Annually – Realign based on goals

🙋 Common Myths Busted

❌ Mutual funds are only for experts – NO. Anyone can start!

❌ You need lakhs to invest – Start with just ₹100

❌ High returns are guaranteed – Returns are market-linked

🧑💼 Why Choose a Mutual Fund Distributor like us ?

✅ Personalized Advice – Funds matched to your goals & risk profile

🧾 Tax Planning Help – ELSS, capital gains & ITR support

📊 Ongoing Portfolio Tracking – Reviews & rebalancing done for you

🧠 Emotional Guidance – Helps avoid panic during market dips

🤝 Human Support – Phone/WhatsApp help, not just apps

We doesn’t just sell funds – we build wealth with you and maintain relations.”

🎯 Final Thoughts

Mutual Funds are India’s most trusted and accessible investment option today — for salaried individuals, business owners, and even students. With the power of compounding and strategic planning, you can build wealth, beat inflation, and achieve your financial goals.

📲 Need help choosing the right fund?

DM us on Instagram @gyc_dineshaneja or

WhatsApp 📞 +91 8800203200