Recent Blog

Category

Mutual Fund

**🌟 The Shine of Silver — 100%+ Gains in 2 Years**

It’s been a dream run for metal investors.

In India, silver has doubled from around ₹70,000/kg to ₹1.45 lakh/kg in just one and half years — rewarding patient investors handsomely.

Gold too has performed well, but silver clearly stole the spotlight in this cycle as expected.

Lately, I’ve been flooded with questions from clients and investors asking — “Silver has doubled in 2 years! Should we book profits or hold on?”

**Here’s my short and clear view 👇**

**⚙️ Why Silver Rallied So Strongly**

✅ Growing industrial demand from solar, EVs & electronics

✅ Tight global supply and low inventory levels

✅ Inflation hedge appeal in uncertain times

✅ Central banks & retail investors adding to demand

**💡 What Should Investors Do Now?**

If you’ve been holding silver and sitting on big gains, it’s time for a strategy check — not panic, not greed.

🔹 1. Book Partial Profits

Lock in 25–40% of your gains.

Secure profits without fully exiting — always better to book smartly than chase peaks.

🔹 2. Diversify Your Portfolio

Shift a portion into gold ETFs or equity mutual funds.

Gold adds stability, equities drive growth. Balance matters more than timing.

🔹 3. Keep a Core Silver Position

Don’t exit completely — industrial and green-energy demand may keep silver buoyant over the next few years.

🔹 4. Watch the Tax Angle

If you’ve held silver for over 3 years, you qualify for 20% long-term capital gains (LTCG) with indexation benefits.

Plan exits accordingly to save tax.

🔹 5. Stay Disciplined

Silver is volatile. Avoid emotional trades and keep portfolio exposure moderate.

Also, Silver has a long history of thrilling investors—and testing their nerves.

**2011 Peak:** Silver skyrocketed from ~$30 to nearly $49/oz in just a few months. Headlines screamed “Silver to $100!” Investor euphoria was at its peak. Retail investors poured in, driven by fear of missing out. But the bubble burst sharply—silver fell back below $30 in the following year.

**2020–2025 Rally:** After years of sideways movement, silver rallied from ~$15 to $27–30/oz, doubling for long-term holders. Once again, euphoria gripped markets—calls, messages, and “silver everywhere” sentiment flooded investors’ minds.

🧭 **The Bottom Line**

Silver has rewarded patience — but every strong rally needs rebalancing.

Celebrate the profits, but stay smart:

👉 Book some gains

👉 Diversify across gold and equity

👉 Hold a core position for the next leg of growth

In investing, discipline always shines brighter than metal. ✨

📞 Need Help Rebalancing Your Portfolio?

Let’s make your gains work smarter.

📲 Call/WhatsApp: +91 8800203200

🌐 Visit: www.gycbydineshaneja.in

📸 Follow on Instagram: @gyc_dineshaneja

Read More →

Category

Mutual Fund

**📈 Investor Note**

**🌾 Agriculture & Trade Dynamics**

🇺🇸 US Interest in Indian Agriculture – The US continues to seek entry into India’s agriculture sector.

🛡️ Policy Safeguards – Strong government policies have limited external access, ensuring protection of domestic interests.

⚠️ External Pressure – Higher tariffs and trade measures are being deployed to create challenges for India’s economy.

**🛍️ Consumption Sector Resilience**

👥 Large Consumer Base – India’s 1.4+ billion population remains a strong driver of demand.

💰 Rising Middle Class – Increasing disposable incomes and expanding middle-class households are fueling steady consumption.

🌾 Agriculture as a Growth Enabler – Rural consumption, supported by agriculture, continues to boost FMCG, retail, and discretionary sectors.

💪 Long-Term Strength – Despite global pressures, India’s domestic consumption-led growth remains resilient and a compelling long-term story.

**💡 Implication for Mutual Fund Investors**

India’s consumption theme continues to be one of the strongest investment opportunities, with agriculture acting as a stabilizing force for rural demand. While external trade challenges may cause near-term volatility, the long-term trajectory of consumption-driven growth makes equity participation—especially in FMCG, retail, consumer discretionary, and rural-focused funds—an attractive proposition for investors.

**📞 Contact for More Insights**

👤 Name: Dinesh Aneja

📧 Email: dineshaneja@gmail.com

🌐 Website: www.gycbydineshaneja.in

📱 Phone: +91 8800203200

📸 Instagram: @gyc_dineshaneja

Read More →

Category

Mutual Fund

**🔍 What is a Mutual Fund?**

A Mutual Fund is a financial vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, gold, and other securities. These funds are professionally managed by Asset Management Companies (AMCs).

📌 You invest.

📌 The fund manager decides where to invest.

📌 You earn returns based on the fund’s performance.

**🧠 Why Should You Consider Mutual Funds?**

✅ Diversification: Spreads your risk across multiple assets

✅ Professional Management: Experts handle your money

✅ Affordability: Start SIPs as low as ₹100/month

✅ Liquidity: Easy to buy/sell, especially in open-ended funds

✅ Transparency: Regular disclosures & regulatory checks by SEBI

**📊 Types of Mutual Funds in India**

[image]mf-type.jpg[/image]

**📈 Realistic Growth – How Much Can You Expect?**

Equity Funds: 12%–18% annually (long-term)

Debt Funds: 5%–8% annually

Hybrid Funds: 8%–12% annually

ELSS: 10%–15% with tax benefits

🕒 Longer horizon = Higher compounding returns

**📊 Mutual Fund Growth Trends (India 2024–2025)**

💰 ₹58 lakh crore+ AUM (Assets Under Management) – July 2025

🚀 Massive inflows in SIPs – ₹20,000+ crore monthly

📈 Surge in midcap, smallcap, and thematic funds

🧑💻 Growing investor base from Tier 2 & Tier 3 cities

**📊 Taxation Summary Table**

[image]tax.jpg[/image]

**🧭 How to Start Your Mutual Fund Journey?**

1️⃣ Define Your Goals

🎯 Retirement, child’s education, dream home, or wealth creation? Start with purpose.

2️⃣ Know Your Risk Appetite

⚖️ Are you conservative, balanced, or aggressive? Your risk level shapes your fund choice.

3️⃣ Choose the Right Fund Type

📈 Short-term = Debt | Medium = Hybrid | Long-term = Equity/ELSS

4️⃣ Start SIP or Lump Sum

💸 Start small with SIPs or go big with lump sum. Automate & stay disciplined.

5️⃣ Track, Don’t React

🔍 Review your funds yearly, not daily. Ignore short-term noise—focus on long-term growth.

**🔑 Pro Tips for New Investors**

🌱 Start Early – Time is your biggest asset

📉 Don't Panic – Markets have short-term noise

🧾 Use SIPs – Rupee cost averaging over time

👩⚖️ Stay Compliant – Complete KYC, track tax rules

📊 Review Annually – Realign based on goals

**🙋 Common Myths Busted**

❌ Mutual funds are only for experts – NO. Anyone can start!

❌ You need lakhs to invest – Start with just ₹100

❌ High returns are guaranteed – Returns are market-linked

**🧑💼 Why Choose a Mutual Fund Distributor like us ?**

✅ Personalized Advice – Funds matched to your goals & risk profile

🧾 Tax Planning Help – ELSS, capital gains & ITR support

📊 Ongoing Portfolio Tracking – Reviews & rebalancing done for you

🧠 Emotional Guidance – Helps avoid panic during market dips

🤝 Human Support – Phone/WhatsApp help, not just apps

We doesn’t just sell funds – we build wealth with you and maintain relations.”

**🎯 Final Thoughts**

Mutual Funds are India’s most trusted and accessible investment option today — for salaried individuals, business owners, and even students. With the power of compounding and strategic planning, you can build wealth, beat inflation, and achieve your financial goals.

**📲 Need help choosing the right fund?**

DM us on Instagram @gyc_dineshaneja or

WhatsApp 📞 +91 8800203200

Read More →

Category

Mutual Fund

**Foreign Portfolio Investors Reshuffling Sector Allocations in Indian Markets**

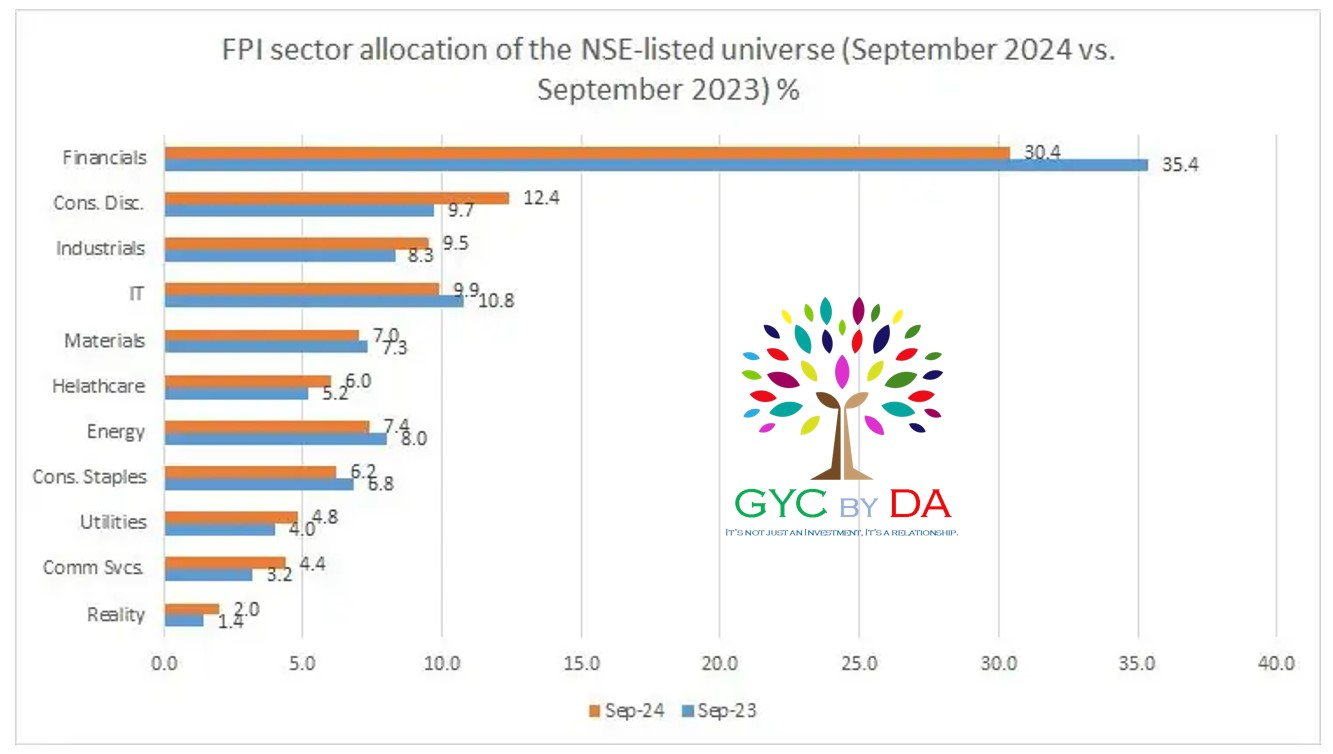

Recently, there has been a noticeable shift in the investment strategies of Foreign Portfolio Investors (FPIs) in the Indian stock market. While many are aware that FPIs have been selling, it is important to understand that this is not a simple sell-off. Instead, there is also a significant restructuring of their investments across different sectors. This change highlights a deeper trend in how global investors are adjusting their portfolios to align with market conditions.

**Decline in Financial Sector Allocations**

One of the most significant changes has been in the financial sector, which includes banks and financial services companies. Over the past year, FPIs have reduced their allocations to this sector. The allocation has dropped from 35% in September 2023 to 30.4% in September 2024. This decline represents nearly a 20% reduction in their investment in financials. The financial sector, which once attracted a large portion of FPI funds, is now seeing a shift away as investors look for more stable or growth-driven opportunities.

**Rising Interest in Consumer Discretionary and Industrials**

On the other hand, the consumer discretionary sector has seen a significant increase in FPI investments. The allocation to this sector has risen from 9.7% to 12.4%, marking a nearly 20% jump in just one year. This sector includes businesses related to goods and services that people buy with discretionary income, such as automobiles, entertainment, and luxury products. Similarly, the industrials sector has also seen a rise in allocation, growing from 8.3% to 9.5%. These shifts indicate that FPIs are becoming more interested in sectors that show potential for stable growth, especially in the post-pandemic world.

**Decline in IT and Energy Sectors**

Another noteworthy change is the reduced allocation in the Information Technology (IT) and energy sectors. The IT sector, which has traditionally been a strong performer, saw its allocation drop from 10.8% to 9.9%. This reduction shows that while IT still remains a significant part of FPI portfolios, investors are becoming more cautious about its future growth potential. Energy also witnessed a drop, reflecting changing global market dynamics and perhaps a shift towards more sustainable and diversified investment opportunities.

**Healthcare and Utilities Gaining Attention**

FPIs have increased their focus on more defensive sectors like healthcare, which saw an increase in allocation from 5.2% to 6%. This suggests that investors are looking for safer bets amid market volatility. Utilities, which provide essential services like electricity and water, have also seen a rise in FPI investments. These sectors are known for their stability, especially during economic downturns, making them attractive to investors who seek lower risk.

**Sector Rotation Instead of Mass Exit**

The changes in sector allocations reveal that FPIs are not simply exiting the Indian market. Instead, they are rotating their investments across different sectors. While there may be a net outflow of funds, the allocation adjustments show a strategic approach. FPIs are moving away from sectors that may be considered overvalued or have reached their peak, such as financials, IT, and energy. At the same time, they are increasing their exposure to more defensive and growth-oriented sectors like consumer discretionary, healthcare, and utilities.

Most of the changes are in line with our strategy except Energy Sector where in we've increase our allocation in last few months. It looks good to see that Big Money is following us or we're one step ahead of the FPI :)

Whatever may be reason, but seems that we're on the right path and doing allocation basis the data points recieved in our own system. This gives confidence on our long term wealth creation journey and add values to our clients trust and their portfolios.

Regards,

**GYC by Dinesh Aneja**

+91 88 00 20 3200

Read More →

Category

Mutual Fund

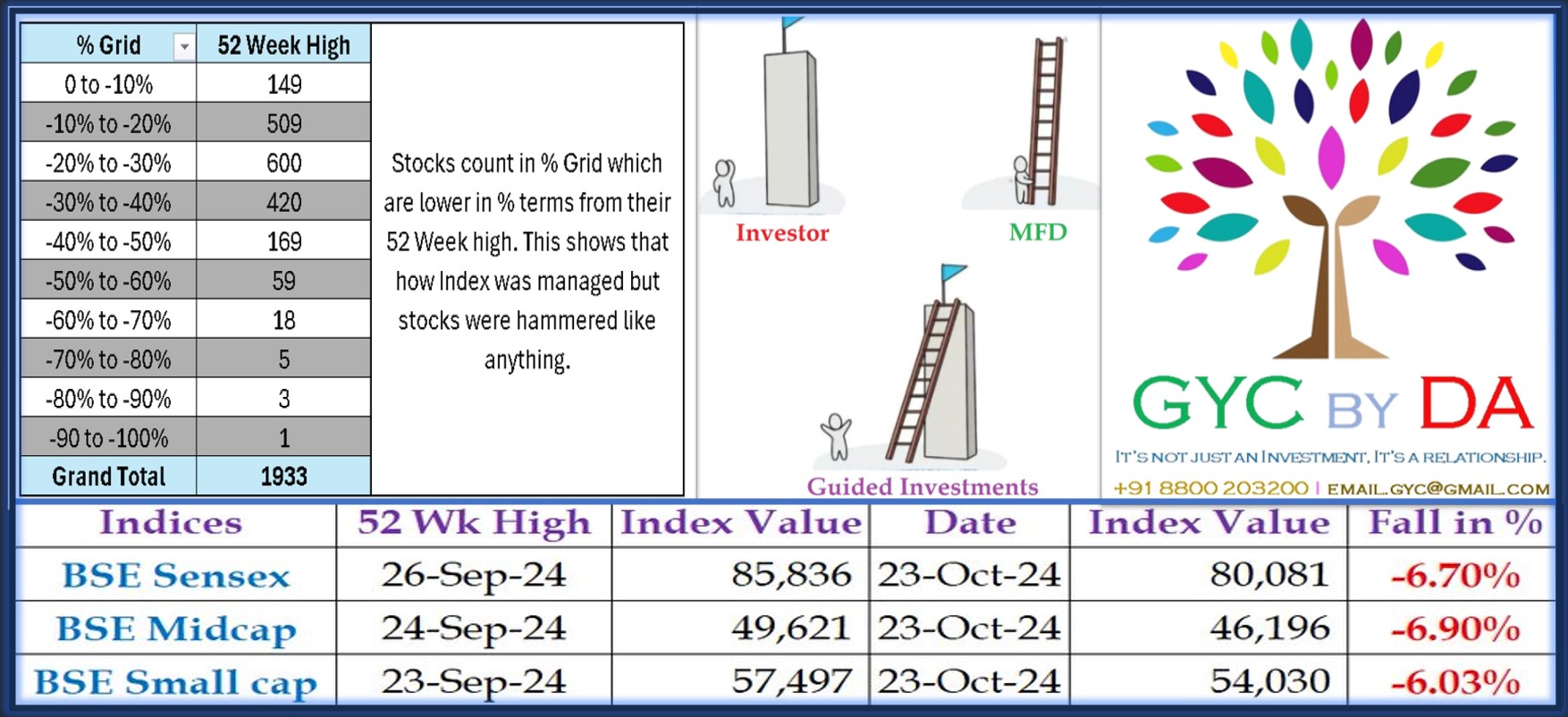

Broader indices are currently down by 7%, causing concerns among many investors. Questions like "What happened to my portfolio?" and "Should I exit now and enter later?" are common during market corrections and I'm getting so many queries now. I had already warned in September and many a times before as well that valuations looks stretched for few sectors specially Mid and Small Cap index. If I talk about the stocks, they have been hammered ruthlessly in last few months. Out of 1900+ stocks listed on NSE India exchange, 70% were down from 10% to 50%. That was the reason that many investors were not able see much growth in their Portfolios which had more concentration of Small and Mid Caps.

Similarly, few sectors run very quikly in last few month but faceing correction now as they got over valued. In Equity Market, chasing returns / sector is very difficult but investors with long term horizon achieve this very easily with proper guidance and research.

However, it's crucial to remember that equity investment is a long-term game. The recent drawdown is just a small draw down of long term wealth creation journey.

Looking back, the Sensex surged from 3,000 to 21,000 between 2003 and 2007, showcasing the market's resilience over time. During the same time market corrected more than 10% on 14 occasions. Market once corrected by 29% and another time by 23% in the same bull run of 5 long years.

**One key piece of suggestion for investors is to avoid checking their portfolios daily. Emotions can lead to reactive decisions that may not align with long-term goals.**

Successful investors understand the importance of staying the course and not being swayed by short-term fluctuations. Patience and a focus on long-term gains are key to navigating the ups and downs of the market.

Regards,

**GYC by Dinesh Aneja

+91 8800203200**

Read More →

Category

Mutual Fund

**The Importance of Sector Selection**

Choosing the right sectors to invest in can make or break your investment strategy. There are years when one sector performs exceptionally well, while others struggle. For example, the automobile sector had a fantastic year in 2014, followed by two relatively bad years in 2015 and 2016. It bounced back in 2017 with an impressive 40% growth but then dipped again in 2018 and 2019 before recovering post-2020. These fluctuations highlight the importance of having a mechanism to exit underperforming sectors while staying invested in sectors that are on the rise.

**The Challenge of Predicting Sector Performance**

It can be incredibly difficult for investors, especially those not following any system or strategy, to predict which sectors will do well. The market is complex, and with ten major sectors to choose from, determining which ones will excel in any given year is a major challenge. Without the help of strategies that automatically select top-performing sectors, investors may find themselves lost in the maze of shifting market trends. This is where the value of structured investment strategies comes into play, offering a systematic approach to sector selection.

**Avoiding Thematic Investments Without a Strategy**

Many investors are tempted to put their money into thematic funds or specific sectors, hoping for a good return. However, this can often lead to long periods of poor performance if the sector they choose does not perform well. For instance, investors who focused on public sector units (PSU) in 2018 and 2019 experienced weak returns during those years. It was only in the last three years that the PSU sector began to recover, rewarding those who stayed invested. Similarly, the pharmaceutical sector had great years in 2014 and 2015, only to suffer four consecutive years of poor performance before bouncing back.

**Embracing a Dynamic Investment Strategy**

The performance of different sectors tends to be cyclical, with new sectoral winners emerging each year. This cyclical nature makes it important for investors to have strategies in place that can adapt to changing market conditions. Momentum strategies, for example, often automatically pick up on sectors that are currently performing well.

So far in last 5 years, we have done very well by rotating the money in Small Cap, Mid Cap, PSU, Infra, Pharma and continue to do well in upcoming sectors of the decade.

Regards,

GYC by Dinesh Aneja

+91 8800 203 200

Read More →

Category

Mutual Fund

Dear Investor,

India’s power sector, shunned by investors for long, is in the spotlight since the pandemic. Economic growth along with technological advancement and electrification threaten a demand surge like never before.

**Govt Policy:**

The National Electricity Plan for central and state transmission systems has projected a total outlay of Rs 9.2 lakh crore. The plan aims to meet a peak demand of 458 gigawatt (GW) by 2032 -- revised higher from the previous estimate of 380 GW. Power sector veterans foresee that power consumption in India will compound by about 7 percent over the next decade.

A detailed report by brokerage and research house MOFS points out that the peak power deficit used to be as high as 15 GW (13 percent of peak demand) in FY2010 and then declined to only 1 GW (or less than 1 percent) during FY19-21. It has been rising over the past two years; in FY23, it surged to 9 GW (4 percent of peak demand).

**Power Consumption and Technology Advancement:**

What’s noteworthy is the shift in power consumption away from core manufacturing industries to new demand drivers such as electric vehicles, data centres and electrification of energy demand. Besides, rising per capita income in India is driving higher household ownership of electrical appliances, too.

Then, there is a powerful price to pay for technological advancement. These technologies such as data centres and artificial intelligence systems that are reckoned to be disruptive, improve efficiencies and cut costs in the long run, are also electricity guzzlers. Ironically, every time consumers around the world undergo a technological upgrade, power demand witnesses a leg-up. For instance, “a simple Google search needs 0.3 Wh of power, while a Chat GPT query consumes 10x the amount of power of a Google search”, according to the Motilal Oswal report.

**Distribution:**

So, with India’s commitment to electrification in mobility and the data centre footprint set to leapfrog, the rising estimates for future power demand appear justified. Details of the NEP indicate significant outlays for transmission systems, storage and distribution and focus on renewable energy and green hydrogen loads into the country's electricity grid.

**What is there for Investors:**

For investors, the much-neglected power sector could turn into a bright long-term opportunity as we informed last week. Some international equity research houses are positive on power asset developers, generators and transmission and distribution companies that are poised to take advantage of the government capital expenditure in this sector. Energy exchanges, too, could gain as expansion of transmission may see new products being launched.

That said, investors must be mindful of uncertain and fluctuating return ratios in the sector, the impact of commodity and component prices on profitability and regulatory risks that have in the past been a stumbling block to private sector investment.

Regards,

GYC by Dinesh Aneja

+91 8800 203 200

Read More →

Category

Mutual Fund

Good Day Investors!!!

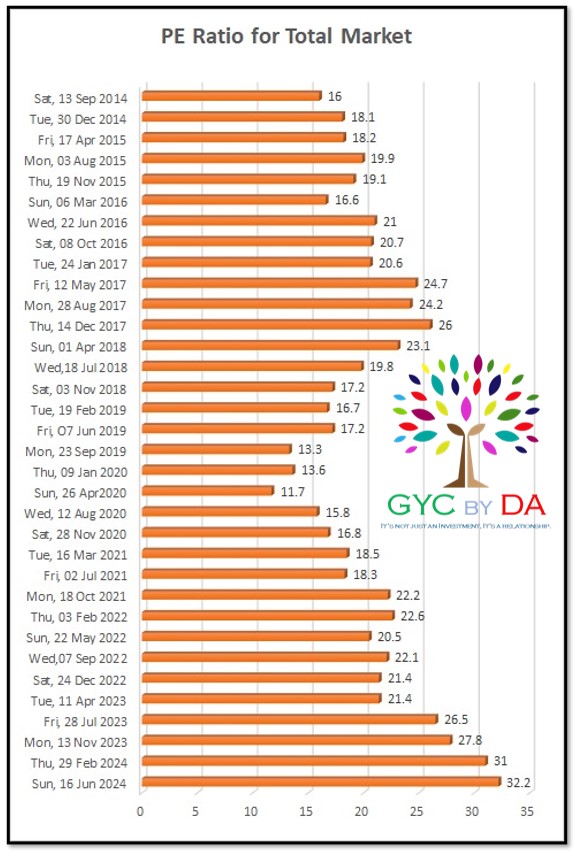

I must confess I have bearish view on midcaps-smallcaps for quite some time now. I never take such calls in haste and I am aware that I am not in business of making predictions but in business of managing risk in my client's portfolios.

Whichever way I slice and dice it my data analysis along with technicals and fundamnentals telling me this is a bubble of epic proportion that will be remembered after long time. We are looking at extremely frustrating phase in coming years. It will be worst for novice traders/investors who want quick money and havn't seen any major downside. The happiest people would be those who do SIP for long term keeping in mind India's growth story intact with Zero loss of emotional capital.

**My call is based on 3 things:**

- Economy is reaching overheated phase and earnings growth will be lower than expected. PE derating + low EPS growth can be killer combination.

- Monetary conditions will remain tight. Rates are cut during recessions not when economy is doing well. Even if are there are odd cuts here and there the liquidity will remain poor. Two other reasons why I don't see big rate cuts are-they hurt savers and lower mortgage rates can create frenzy in real estate crowding out middle class population. I would be surprised if 10Y Gsec dip below 6.5% in next 2 yrs.

- Big ticket purchase(housing, cars, travel) will slow down due to uncertainty in the job market. Recent data of Car manufacturers shows that More care in Yard than showroom as of last month. One of the reasons for big boom in big ticket purchase was massive wage hikes in 2021-22. Similary, lilquidity is drying up and it will drag market more than expected. All the assets class have run up a lot in last few years and it definitely need a break and overhaulign of the system.

Valuations 1 year back were what they were at the top of 2018. So its only got more and more ridiculous as the market has gone up relentlessly and without any breaks. I've personally shifted from Mid and Small Cap to defensive funds a month back. My system says that profit which is not booked is not a profit. My Long Term targets of Indian market remains the same for 2030 and beyond but current level looks like a bubble where new clients want to onboard every now and then and bus seems to be over crowded.

Stay Safe, control on greed and take a pause to run farther in long run.

Regards,

GYC by Dinesh Aneja

Read More →

Category

Mutual Fund

Ever wondered how your daily choices shape India's economy? From the smartphone in your hand for groceries you buy, your decisions fuel a consumption revolution. Today I want to share why the Consumption Fund is a unique investment opportunity.

India is transforming rapidly, it's now the fifth largest consumption market in the world and with the country's per capita income crossing $2,000, we are witnessing a significant surge in consumption spending.

But what's fusing this transformation? Let's take a closer look. India's consumption story is booming. With rising incomes, more people are spending on a better lifestyle. As the largest young population in the world, with a median age of 28, India is driving a shift towards diverse product preferences.

By 2031, India will comprise 25% of the world's working population. This is leading to rapid urbanization as a large young workforce migrates to cities for better job opportunities and higher living standards. The burgeoning urban middle class is driving a consumption revolution, trading up to premium products and experiences.

E-commerce and digital payments are enabling this spending spree, catering to evolving preferences while easy access to credit is bolstering spending power. This consumption surge presents substantial investment opportunities. That's where the Consumption Fund comes in.

The fund's strategic investing sector poised to benefit the most from these trends, including autos, FMCG, healthcare, retail, power, and e-commerce. The fund focuses on quality companies with strong growth potential and actively manages a diversified portfolio to balance risks and results. The New Fund offers you a chance to be part of India's dynamic road story.

So, join us in harnessing the potential of one of the fastest growing economies and be a part of phenomenal Growtw by investing in the fund which can create wealth for you in long run.

Thanks

Read More →

Category

Mutual Fund

**How IDCW (earlier known as mutual fund dividend) is different from stock dividend?**

When we receive a dividend from a stock we hold, it is sharing of profit earned by the respective company. When a company declares dividend on its stock, it does not bring down the stock price anyway. In layman’s term, we can refer receiving dividend from stocks as ‘extra income’ which is over and above the unrealized or realized gains we receive from holding that stock.

But in case of mutual fund, ‘dividend’ is compulsorily to be paid out from realized gains by the fund manager. So, paying out such ‘dividend’ of course results in a drop of its unit value or NAV as it is distributing income to certain unit holders (who opted for it) by withdrawing from its capital – thus the apt name for this activity is Income Distribution cum Capital Withdrawal.

**What is SWP (Systematic Withdrawal Plan) then?**

In case of SWP, fund manager has no role to play. Instead, you are at the driver’s seat. It is nothing but you are redeeming your units, irrespective of whether that means realizing gain or loss. In case of IDCW, it must come from realizing gains, no exception there. Also, declaring ‘dividend’ from a mutual fund scheme depends solely on the fund manager. It is up to him or her to decide, both the ‘dividend’ amount and frequency.

**How are SWWP and IDCW taxed?**

IDCW or ‘dividend’ income received from a mutual fund scheme adds to a unit holder’s income (under ‘income from other sources’) and therefore taxed accordingly. So, if you are in 30% tax bracket, you are then taxed accordingly. In case of SWP, it comes to you as ‘capital gain’ (short-term or long-term) and not as income for you. Now, we all know that short-term gain from equity mutual fund is taxed at 15% and long-term gain from equity mutual fund is taxed at 10% (beyond Rs. 1 lakh gain from equity holding in a financial year). So taxing of SWP income has nothing to do with what tax bracket you fall into.

**Conclusion**

If you want to receive regular income from your mutual fund holdings at your preferred terms – that is frequency and amount of income are decided by you – then go for SWP. The added benefit here is SWP’s tax efficiency over IDCW option.

Shakespeare said – What’s in a name? But in reality, naming a thing has lot to do with how we perceive a thing. Take, for example what we used to refer earlier (many of us still use that in casual terms) as ‘Dividend’ in a mutual fund. That time, it was often thought that dividend received from a mutual fund scheme is same as dividend received from a stock we hold, which it is not. To clear that confusion, SEBI rechristened it as IDCW (Income Distribution cum Capital Withdrawal). Did this rename help? Let’s see.

Read More →