Recent Blog

How HUF Helps in Tax Saving: Meaning, Benefits & Strategy

💡 HUF & Tax Saving Explained

A Hindu Undivided Family (HUF) is a powerful and fully legal tax-saving structure under Indian income tax law. It helps in income splitting and long-term wealth management by treating the family as a separate taxable entity.

🔑 Key Highlights:

• HUF is treated as a separate “person” from its members for tax purposes. • Income can be legally split between individual members and the HUF, reducing overall tax liability. • HUF can claim deductions under Section 80C, 80D, and capital gains exemptions, just like an individual. • Enjoys a separate basic exemption limit: – ₹2.5 lakh under the Old Tax Regime – ₹4 lakh under the New Tax Regime

📌 What is an HUF?

HUF stands for Hindu Undivided Family. It is a separate legal entity recognized under the Income Tax Act, created specifically for tax purposes.

An HUF is one of the most effective and fully legal tax-saving structures available to joint families.

An HUF can: • Own property • Earn income • Make investments • Claim tax benefits independently of its members

This helps families reduce their overall tax liability by legally splitting income between individuals and the HUF.

The head of the HUF is called the Karta, and the family members are known as coparceners.

👨👩👧👦 Who Can Form an HUF?

• Hindu, Buddhist, Sikh, and Jain families are all eligible to form an HUF. • An HUF cannot be created by a single person — a minimum of two members is required. • There must be a family with lineal ascendants and descendants. • An HUF can also come into existence upon marriage.

👥 Who Are the Members of an HUF?

An HUF consists of a common ancestor and all lineal descendants, including their wives and unmarried daughters.

🔹 Karta

• The head of the HUF, usually the senior-most male or female member. • Manages the HUF’s financial and legal affairs. • Has unlimited liability, including for tax obligations.

🔹 Coparceners

• All male and female lineal descendants of the common ancestor. • Daughters are coparceners by birth with equal rights. • Have the right to demand partition of HUF property.

🔹 Other Members

• Wives of coparceners become members after marriage. • They are not coparceners. • Have maintenance rights but cannot demand partition.

📌 Important Note:

Only coparceners can seek partition of an HUF, while the Karta bears unlimited liability for HUF dues, including taxes.

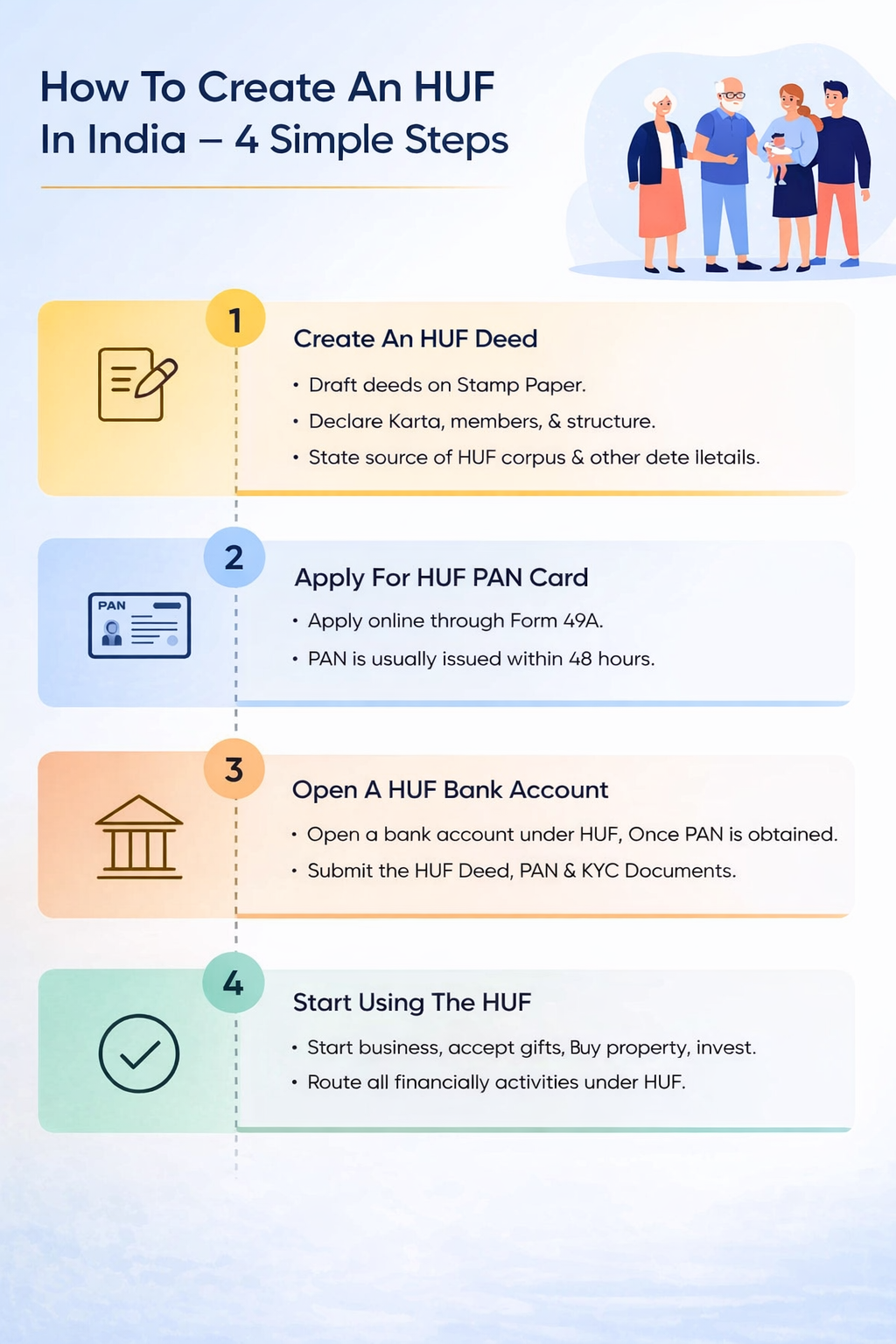

🧾 How to Form an HUF – Step-by-Step Guide

Forming a Hindu Undivided Family (HUF) is a simple and legal process. It mainly involves creating an HUF deed, obtaining a PAN, opening a bank account, and starting HUF operations.

✅Step 1: Create an HUF Deed

The first step is to draft an HUF deed.

The deed should include:

• Name of the Karta

• Names of coparceners/members

• Personal details of all members

• Date of formation of HUF

• Initial HUF corpus and its source

• Any other relevant declarations, as required

📌 This deed acts as the foundation document of the HUF.

✅ Step 2: Obtain a PAN Card for HUF

• Apply online for a separate PAN card in the name of the HUF.

• The Karta applies using Form 49A along with necessary declarations.

• In most cases, the PAN number (digital PAN) is generated within 48 hours.

✅ Step 3: Open an HUF Bank Account

• Once the PAN is issued, open a bank account in the name of the HUF.

• All HUF income and expenses should be routed through this account.

• Documents generally required: – HUF Deed – HUF PAN – Karta’s PAN & KYC documents

✅ Step 4: Transfer Common Assets to HUF

• Assets meant for HUF use—such as property, cash, deposits, or investments—can be transferred to the common HUF pool.

• These assets will then generate income taxable in the hands of the HUF.

📊 Tax Implications of HUF

🏠 HUF Residential Status

The residential status of a Hindu Undivided Family (HUF) depends on where its control and management are exercised during the financial year.

✅ Resident HUF

An HUF is considered Resident in India if: • Its control and management are wholly or partly in India during the previous year.

📌 Partial control in India is sufficient to treat the HUF as resident.

Based on Karta’s status: • If the Karta is Resident and Ordinarily Resident (ROR) → HUF is ROR • If the Karta is Resident but Not Ordinarily Resident (RNOR) → HUF is RNOR

❌ Non-Resident HUF

An HUF is treated as Non-Resident if: • Its control and management are wholly outside India during the previous year.

🔎 Bottom Line

The residential status of an HUF is primarily linked to the residential status of the Karta, only when the HUF is controlled or managed from India. If the control and management are outside India, the HUF will be treated as Non-Resident, regardless of other factors.

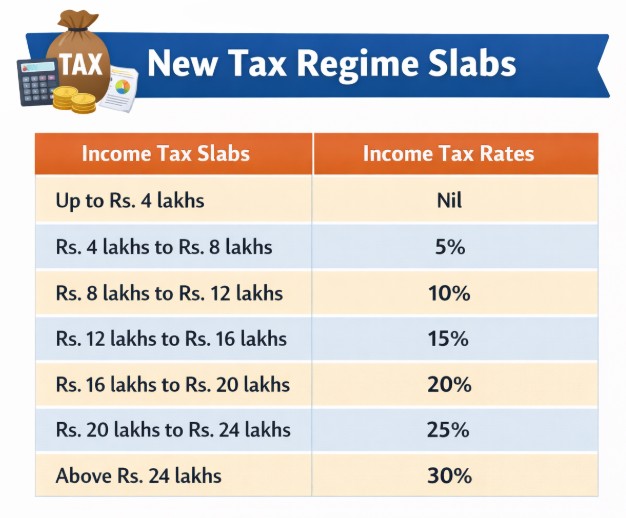

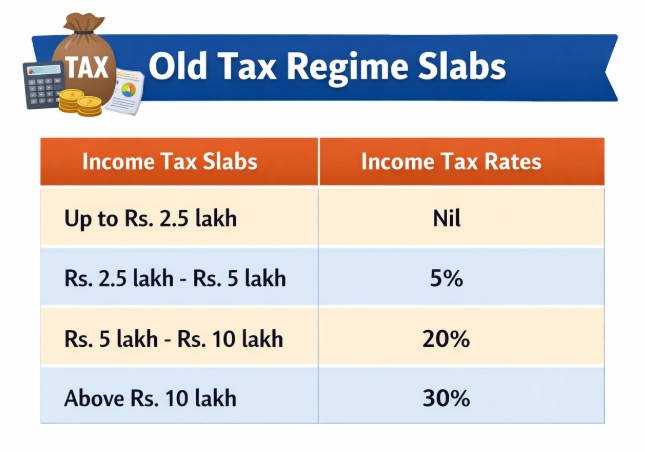

💰 HUF Tax Slabs

• HUF taxation is similar to individual taxation, with minor differences. • Tax slabs for HUF are the same as for individuals under both: – Old Tax Regime – New Tax Regime

📌 The tax slabs remain the same whether the HUF is Resident or Non-Resident, under both regimes.

New Tax Regime Slabs

Under the new regime, the tax slabs of HUF for the financial year 2025-26 are as follows:

Old Tax Regime Slabs

📌 Note:

👴👵 Relaxed slab rates available for resident senior & super senior citizens are ❌ not applicable to HUF.

💰 Surcharge and cess will be applicable as per prevailing rates.

🔔 Rebate – Important Clarification

❌ It is a common misconception that HUFs can claim rebate if taxable income is: • below ₹7 lakh (New Regime) • below ₹5 lakh (Old Regime) • below ₹12 lakh (New Regime for FY 2025-26)

👉 Reality: 🚫 Rebate is NOT available to HUFs. ✅ Rebate can be claimed only by Resident Individuals, not HUFs.

🏛️ HUF Tax Benefits (Still Powerful!)

✅ HUF is treated as a separate taxable person, different from its members. ✅ Hence, separate tax slabs & deduction limits apply. 📊 Income can be legitimately split between members and HUF, helping reduce overall family tax liability.

Basic Exemption Limit:

• 🧾 Old Regime: ₹2.5 lakh • 🧾 New Regime (FY 2025-26): ₹4 lakh

💡 Key Tax Benefits Available to HUF

🔹 Section 80C – Deduction up to ₹1.5 lakh 👉 PPF, ELSS, Life Insurance, etc.

🔹 Section 80D – 🏥 Deduction on health insurance premium paid for HUF members

🔹 Section 80G – ❤️ Deduction on eligible donations made by HUF

🔹 Home Loan Benefits – 🏠 Deduction on interest paid on housing loan

🔹 Capital Gains Exemptions – 📈 Relief under Sections 54, 54F & 54EC on reinvestment of long-term capital gains

🏛️ How to Save Taxes by Forming an HUF?

Let’s understand HUF taxation with a simple example 👇

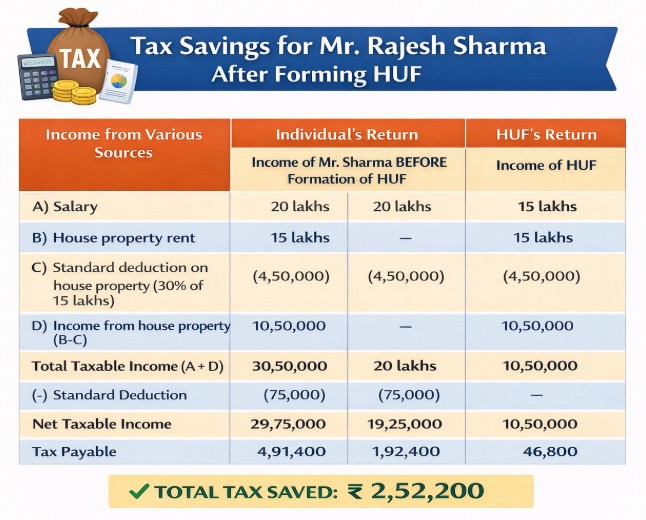

👨💼 Case Study

👤 Mr. Rajesh Sharma forms an HUF with: 👩 Wife | 👦 Son | 👧 Daughter

🏠 A property owned by Mr. Sharma is transferred to the HUF, earning: ➡️ Annual Rental Income: ₹15 lakh

💼 Mr. Sharma’s Salary Income (individual): ₹20 lakh

📊 Tax Impact – New Tax Regime (FY 2025–26) 🔹 Without HUF (Only Individual Income)

👉 Total Income = ₹35 lakh 💸 Entire income taxed in Mr. Sharma’s hands ➡️ Higher slab = Higher tax outgo

🔹 With HUF Structure (Smart Planning)

🧍 Mr. Sharma (Individual): 💼 Salary Income = ₹20 lakh

🏛️ HUF (Separate Tax Entity): 🏠 Rental Income = ₹15 lakh

👉 Income is now split between two PANs ✔️ 👉 Separate basic exemption for HUF applies ✔️ 👉 Lower effective tax slabs ✔️

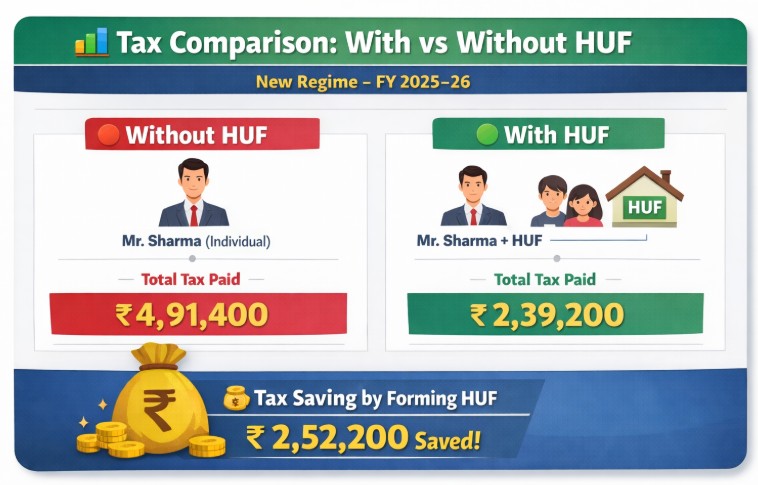

📊 Tax Comparison: With vs Without HUF (New Regime – FY 2025–26)

⚠️ Risks & Challenges of an HUF

While an HUF is an effective tax-saving tool, it also comes with certain limitations 👇

❌ Key Disadvantages of Forming an HUF

🔹 Partition Disputes 👨👩👧👦 Differences among family members can lead to legal and emotional conflicts.

🔹 Complex Compliance 📑 Separate PAN, ITR filing, accounting & documentation increase compliance burden.

🔹 Limited Applicability ⚖️ Benefits apply only in specific income scenarios (rent, capital gains, investments).

🔹 HUF Cannot Receive Salary 🚫 Salary income cannot be routed through HUF — it must be earned by individuals only.

🔹 Dissolution is Not Easy 🔒 Once created, exiting an HUF can be complicated.

🏛️ Dissolution of an HUF (Partition)

An HUF can be dissolved only through partition, where assets are distributed among coparceners (members with inheritance rights).

🔸 Types of Partition:

✅ Total Partition 📦 All HUF assets are divided 🚫 HUF ceases to exist

✅ Partial Partition 📦 Only some assets are divided 🔄 HUF continues with remaining assets

📜 Legal Requirements for Valid Partition

📝 Partition Deed must be: ✔️ Drafted ✔️ Properly stamped ✔️ Registered

🪪 HUF PAN Card ➡️ Must be surrendered to tax authorities after total partition

📌 Bottom Line: 🧠 HUF is powerful for tax planning ⚠️ But needs family harmony, long-term vision & professional structuring

A Hindu Undivided Family (HUF) is a separate legal and tax entity under Indian income tax laws, consisting of a common ancestor and lineal descendants. An HUF has its own PAN, tax slabs, and deduction limits, enabling legal income splitting and tax optimisation. It can earn income from assets, investments, and capital gains, though salary income cannot be routed through an HUF.

📌 Disclaimer: This information is for general awareness only. Tax treatment may vary based on individual circumstances—please consult your Chartered Accountant (CA) or tax advisor for detailed and personalised advice.